News Release

The Rise of Target Date Funds: ISS MI BrightScope and ICI’s Closer Look at 403(b) Plan Investments

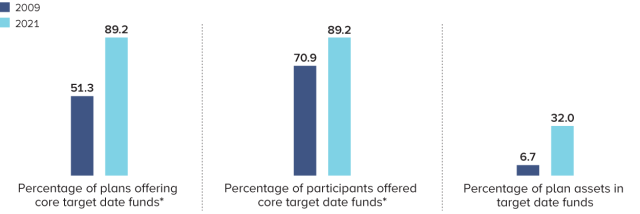

Washington, DC; December 23, 2024—The Investment Company Institute (ICI) and ISS Market Intelligence (MI) today released their collaborative report on 403(b) plans subject to the Employee Retirement Income Security Act of 1974 (ERISA), The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at ERISA 403(b) Plans, 2021. The report highlights the growing popularity of target date funds in large ERISA 403(b) plans. Since 2009, the proportion of these plans offering target date funds in their core investment lineups has increased significantly, from about half of large ERISA 403(b) plans in 2009 to about nine in 10 plans in 2021.

“Over the past several years, target date funds have continued to become more prevalent in large ERISA 403(b) plans,” stated Sarah Holden, ICI Senior Director of Retirement and Investor Research. “A target date fund offers participants a diversified investment solution that gradually shifts from growth to income-focused strategies as the fund approaches and passes its target date, making it a valuable and accessible option for retirement plan participants.”

Target Date Fund Offering and Use Have Risen in Large ERISA 403(b) Plans

* Core target date funds are target date funds included in a suite of funds that holds at least 0.5 percent of plan assets.

Note: A target date fund typically rebalances its portfolio to become less focused on growth and more focused on income as it approaches and passes the target date of the fund, which is usually included in the fund’s name. Funds include mutual funds, collective investment trusts, separate accounts, and other pooled investment products. ISS MI audited 401(k) filings generally include plans with 100 participants or more. In 2021, the sample is 6,282 plans with 6.3 million participants and $0.7 trillion in assets.

Source: ISS MI BrightScope Defined Contribution Plan Database

The study also reports that 403(b) plans offer a wide array of investment options, typically including domestic equity, international equity, domestic bond, and target date funds. Mutual funds were the most common investment vehicle, accounting for 68 percent of large ERISA 403(b) plan assets in 2021. Variable annuities made up 18 percent of large ERISA 403(b) plan assets, while fixed annuities represented 14 percent.

“Mutual funds continue to be a cornerstone of 403(b) plans, underscoring funds’ widespread importance in providing cost-effective, diversified investment options” clarified Brooks Herman, Managing Director, BrightScope at ISS MI. “Equity and balanced funds play key roles in shaping these retirement portfolios, and falling fund fees further support 403(b) plan participants’ accumulations."

Other key findings of the study include:

- ERISA 403(b) plans represent an array of nonprofits, often hospitals or educational services. About half of ERISA 403(b) plan participants are in hospital plans, which held 38 percent of ERISA 403(b) plan assets in plan year 2021. Another 23 percent of ERISA 403(b) plan participants were in educational services, holding nearly half (44 percent) of ERISA 403(b) plan assets.

- Most large 403(b) plans offer employer contributions. In 2021, more than four-fifths of large ERISA 403(b) plans covering three-quarters of large ERISA 403(b) plan participants had employer contributions.

- 403(b) plans offer employees a robust lineup of investment options. The average large ERISA 403(b) plan offered 27 core investment options in 2021—of those, about 11 were equity funds, two were bond funds, and 11 were target date funds. Nearly all plans offered domestic equity, international equity, domestic bond, and target date funds. Eighty-one percent of large ERISA 403(b) plans offered fixed annuities.

- Index funds are widely available in large ERISA 403(b) plans. In 2021, 94 percent of large ERISA 403(b) plans included index funds in their core investment offerings, and index funds represented 38 percent of large ERISA 403(b) plan assets.

About the Study

This report in The BrightScope/ICI Defined Contribution Plan Profile series focuses on ERISA 403(b) plans in 2021. It first analyzes 403(b) plans in the Department of Labor 2021 Form 5500 Research File. Focus then shifts to nearly 6,300 audited 403(b) plans in the ISS MI BrightScope Defined Contribution Plan Database, which typically have 100 participants or more. For analysis of private-sector 401(k) plans, see The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2021 (August 2024).

About ISS Market Intelligence

ISS Market Intelligence (MI) is a leading provider of data, insights, and market engagement solutions to the global financial services industry. ISS MI empowers asset and wealth management firms, insurance companies, distributors, service providers, and technology firms to assess their target markets, identify and analyze the best opportunities within those markets, and execute on comprehensive go-to-market initiatives to grow their business. Clients benefit from our increasingly connected global platform that leverages a combination of proprietary data, powerful analytics, timely and relevant insights, in-depth research, as well as an extensive suite of industry-leading media brands that deliver unmatched market connectivity through news and editorial content, events, training, ratings, and awards.

Complete results of the annual BrightScope/ICI study are posted on www.ici.org/research/retirement/dc-plan-profile. To learn more about ISS Market Intelligence, visit www.issmarketintelligence.com.