News Release

UCITS: A Cost-Effective Savings Vehicle Benefitting Investors Worldwide

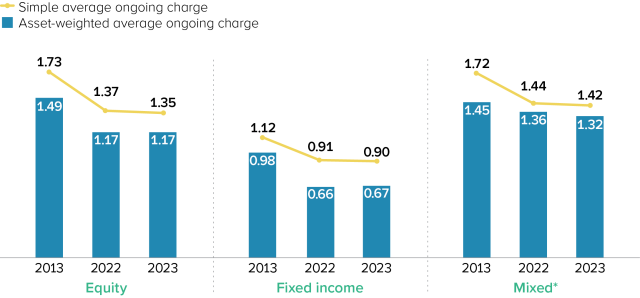

Washington, DC, December 19, 2024—UCITS remain a global success story, serving as a cost-effective savings tool for investors worldwide since their adoption in 1985. An updated report from the Investment Company Institute (ICI), Ongoing Charges for UCITS in the European Union, 2023, shows the average ongoing charge for equity UCITS remained unchanged in 2023, and the average ongoing charge for fixed-income UCITS increased by one basis point. While these average ongoing charges remained generally flat in that one-year period, the report also highlights that the 10-year trends for both equity and fixed income UCITS were down 21 percent and 32 percent, respectively.

These findings show that UCITS continue to offer enduring value, providing investors with a high-quality and cost-efficient solution for achieving long-term savings and investment goals.

Investors in UCITS Pay Below-Average Ongoing Charges

Percent

*Mixed funds invest in a combination of equity and fixed-income securities.

Note: Data exclude UCITS ETFs.

Source: Investment Company Institute calculations of Morningstar Direct data

“UCITS have proven to be an attractive product for retail investors saving for the long term because they provide low-cost, diversified access to global markets, professional management, and a sound regulatory framework,” said James Duvall, ICI’s assistant director for industry and financial analysis.